aurora sales tax rate 2021

North Carolina has state sales tax of 475 and allows local governments to collect a local option sales tax of up to 275There are a total of 458 local tax jurisdictions across the state collecting an average local tax of 222. The minimum wage will not increase when Cook Countys unemployment rate is greater than 85 for the preceding year.

Aurora Kane County Illinois Sales Tax Rate

JLL publishes 2021 Global Sustainability Report.

. Eight states impose no state income tax and a ninth New. Fill in the sales tax rate for any state where you want to charge sales tax. The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744.

Berwyn IL Sales Tax Rate. Click here for a larger sales tax map or here for a sales tax table. Colorado to stop sales tax on diapers and menstrual products The state estimates the legislation will save Coloradans a combined 91 million annually.

Counties and cities can charge an additional local sales tax of up to 71 for a maximum possible combined sales tax of 10. JLL launches non-profit focused on. Must contain at least 4 different symbols.

Ohio has state sales tax of 575 and allows local governments to collect a local option sales tax of up to 225There are a total of 576 local tax jurisdictions across the state collecting an average local tax of 1504. Click here for a larger sales tax map or here for a sales tax table. Cities using more regulation to reach net-zero targets through decarbonization of buildings.

Including Arapahoe Park and Aurora Reservoir and Douglas County northern portion consisting of. C Gas electricity and other specified fuels for residential use 39-26-7151aII CRS. Combined with the state sales tax the highest sales tax rate in Kansas is 115 in the cities of.

Colorado has 560 special sales tax jurisdictions with local sales taxes in. Combined with the state sales tax the highest sales tax rate in South Dakota is 75 in the. 6 to 30 characters long.

This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing. South Dakota has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 6There are a total of 290 local tax jurisdictions across the state collecting an average local tax of 1817. Find new and used cars for sale on Microsoft Start Autos.

Total Sales Tax Rate. Sales Tax General Information. Gross Bookings of 259 billion up 51 year-over-year and at the high end of the guidance range Net income of 892 million including a 14 billion net benefit relating to Ubers equity investments Adjusted EBITDA of 86 million was above the guidance range with Delivery reaching Adjusted EBITDA profitability for Q4 Uber Technologies Inc.

The latest sales tax rates for cities in Colorado CO state. City of Aurora - opens in new window or tab. Aurora CO Sales Tax Rate.

Click stars to rate More About Dell Home Office Coupons. Raised from 85 to 875 Aurora and Watkins. Xcel Energy asks for yet another rate.

Arvada CO Sales Tax Rate. Wednesday July 01 2020. Missouris median income is 56517 per year so the median yearly property tax paid by Missouri residents.

Aurora sales tax applies to the retail sale or rental of all tangible personal property. Some local governments also impose an income tax often based on state income tax calculations. Boulder CO Sales.

Groceries and prescription drugs are exempt from the Colorado sales tax. Bloomington IL Sales Tax Rate. JLL climbs Fortune 500.

Missouri has one of the lowest median property tax rates in the United States with only fifteen states collecting a lower median property tax than Missouri. Alaska Remote Seller Sales Tax Commission - opens in new window or tab. Find low everyday prices and buy online for delivery or in-store pick-up.

2020 rates included for use while preparing your income tax deduction. In addition to federal income tax collected by the United States most individual US. This weekly ad-style circular is one of the best places to find out about upcoming sales events releases and flash sales.

Colorado has recent rate changes Fri Jan 01 2021. Cook County enacted its own minimum wage ordinance in 2016. November 2021 86 changes Over the past year there have been 982 local sales tax rate changes in states cities and counties across the United States.

Click here for a larger sales tax map or here for a sales tax table. Combined with the state sales tax the highest sales tax rate in Ohio is 8 in the cities of. Amazons tax behaviours have been investigated in China Germany Poland Sweden South Korea France Japan Ireland Singapore Luxembourg Italy Spain United Kingdom multiple states in the United States and Portugal.

Get a great deal on a great car and all the information you need to make a smart purchase. According to a report released by Fair Tax Mark in 2019 Amazon is the best actor of tax avoidance having paid a 12 effective tax rate between 2010-2018 in. Click here for a larger sales tax map or here for a sales tax table.

Aurora IL Sales Tax Rate. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. The median property tax in Missouri is 091 of a propertys assesed fair market value as property tax per year.

Annual increases based on the percentage change in the CPI-U beginning July 1 2021 capped at 25 rounded to the nearest 5 cents. Rates include state county and city taxes. The products are defined as tangible personal property designed for.

Combined with the state sales tax the highest sales tax rate in North Carolina is 75 in. Forty-two states and many localities in the United States impose an income tax on individuals. It also applies to the retail sale of certain services that are listed below.

2020 rates included for use while preparing your income tax deduction. 660 to 740 effective 7. Shop Motorola Moto G Stylus 2021 128GB Memory Unlocked Aurora White at Best Buy.

Minnesota has state sales tax of 6875 and allows local governments to collect a local option sales tax of up to 15There are a total of 273 local tax jurisdictions across the state collecting an average local tax of 0521. 10-24-2021 at 1219 PM. Last week the Town of Estes Park received the Sales Tax Revenue Report for the month of June from the State of Colorado which shows that collections for the month increased by 378 percent going.

For those that purchased this earlier this month at 359 dell has a. JLL names Larry Quinlan to its Board of Directors. This page allows you to browse all recent tax rate changes and is updated monthly as new sales tax rates are released.

The exemption from City sales and use tax is eliminated with the passage of ordinance number 2019-64. City of Avon - opens in new window or tab. Combined with the state sales tax the highest sales tax rate in Minnesota is 8875 in the.

Rates include state county and city taxes. States collect a state income tax. Click here for a larger sales tax map or here for a sales tax table.

Kansas has state sales tax of 65 and allows local governments to collect a local option sales tax of up to 4There are a total of 529 local tax jurisdictions across the state collecting an average local tax of 1987. The latest sales tax rates for cities in Illinois IL state. The Colorado sales tax Service Fee rate also known as Vendors Fee is 00400 40 with a.

ASCII characters only characters found on a standard US keyboard.

How To Pay Sales Tax For Small Business 6 Step Guide Chart

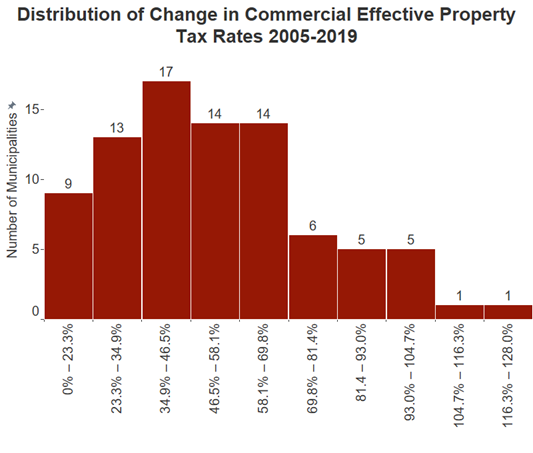

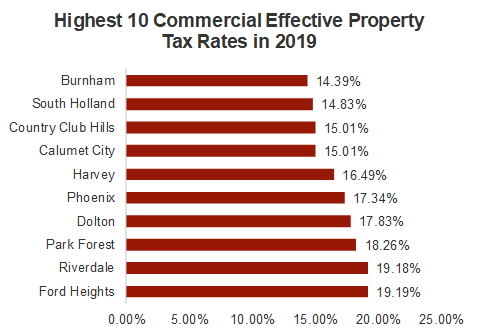

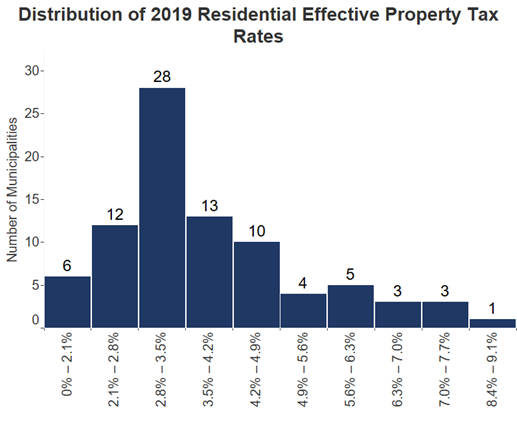

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Nebraska Sales Tax Rates By City County 2022

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Illinois Car Sales Tax Countryside Autobarn Volkswagen

New York Sales Tax Rates By City County 2022

Kansas Sales Tax Rates By City County 2022

Sales Tax By State Is Saas Taxable Taxjar

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Colorado Sales Tax Rates By City County 2022

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Missouri Sales Tax Rates By City County 2022

Ohio Sales Tax Rates By City County 2022

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute